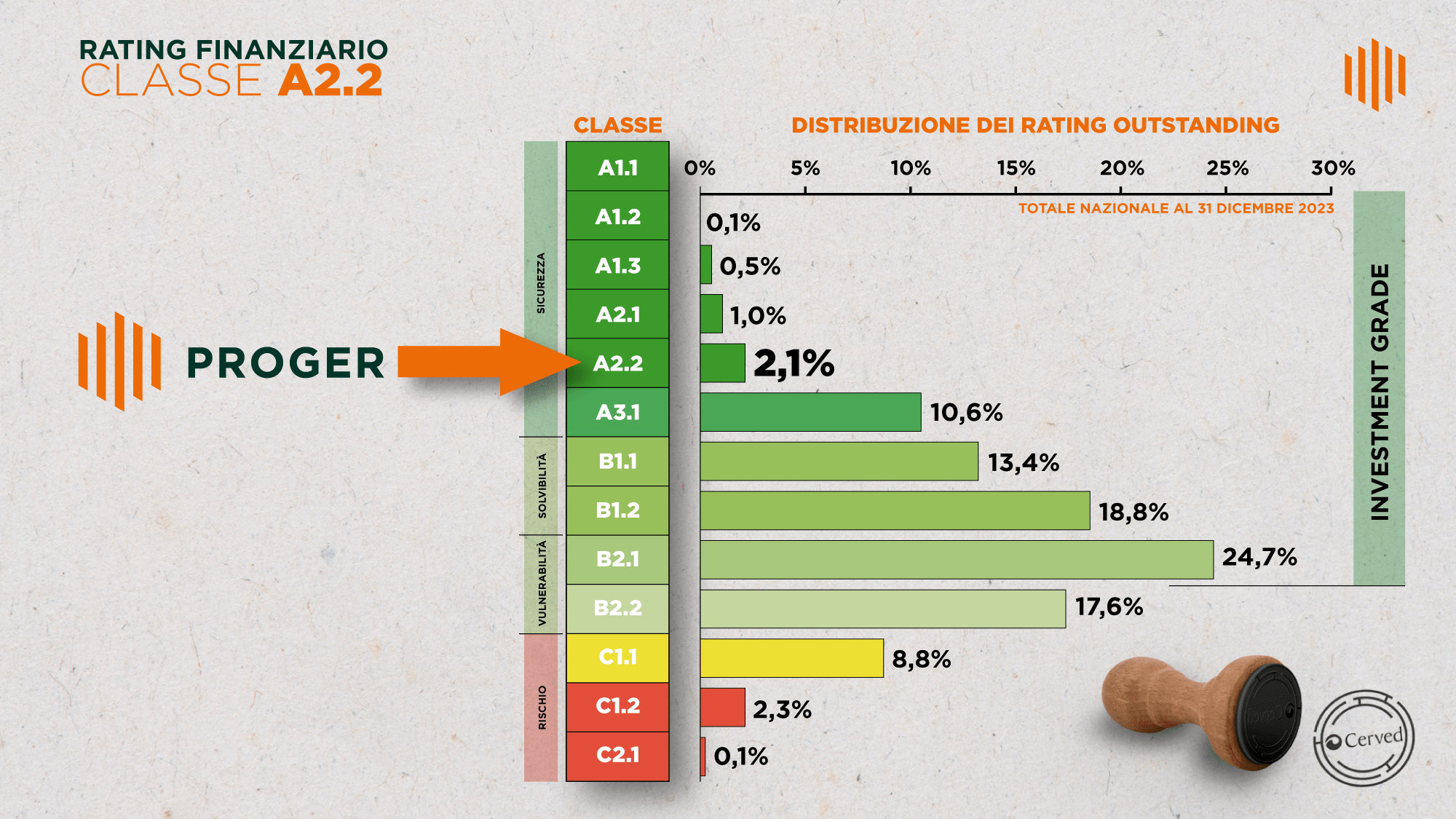

Proger, an A2.2 rating puts the company in the top tier of financial reliability

Thanks to the upgrade recognized by the Cerved rating agency, Proger joins the elite group of less than 4% of Italian companies

Proger S.p.A. announces that Cerved, one of Europe’s leading rating agencies, has raised the Company’s public rating from A3.1 to A2.2: “Company with very strong fundamentals and high ability to meet financial obligations. Very high creditworthiness”.

“An important upgrade on the already excellent result of previous years”, comments CFO Roberto Lombardi, “which confirms Proger’s solidity in the financial system and repositions it today among the companies in the 4th percentile of Cerved’s rating ranking“.

The analysis carried out by Cerved on the 2023 pre-closing results is the outcome of several factors, such as the considerable and diversified order portfolio, which has allowed and will allow significant developments in both production volumes and margins, a satisfactory organizational and governance model, and an efficient and effective internal control system to monitor the Group’s financial and operational management risks.

The 2023 results show a production value of 186.9 million (+70%), an Ebitda of 24.5 million (+67%), a net profit of almost 15 million (+65%) and a shareholders’ equity of 84.8 million (+21.4%).

The reduction in net financial debt (pfn), which amounted to 21 million (-33%), was significant and, thanks to the increase in margins generated, further improved the already excellent pfn/ebitda ratio, which stood at 0.86 for the year under review (a value of excellence that expresses, in a synthetic way, Proger’s ability to repay, with the margin generated and in less than 12 months, the debt contracted with the financial system).

Contained the weight of financial costs (approximately 1.8% of VdP) thanks to efficient financial planning and solid relationships with credit institutions, despite the generalized and significant increase in interest rates and the change in gross debt (+15.6%), supporting the increase in production value.

Balanced distribution of market risk among the main business lines. In this regard, a significant stability can be noted in Oil & Gas, with respect to the production of the previous year, while a significant growth can be seen in Infrastructure, with an increase of +36.1 million (ASPI, RFI, WeBuild contracts), in Multidisciplinary Engineering, which expresses +13.6 (Saudi Arabia Branch contracts) and in Green Energy (+26.8 million), whose contribution is mainly related to energy efficiency projects for real estate assets and condominiums.

It should also be noted that the 2023 Preclosing Value of Proger S.p.A. does not include the increase in production of its main subsidiaries, among which we mention Proger Egypt (+21.5 mln) – Petrobel / ENI order for the design and construction of a 160 mln headquarters in 4 years – and I.M.P. S.r.l. (+8 mln), an Italian engineering company with expertise in the activities of monitoring and surveillance of works of art.

Lombardi concludes: “These results are the consequence of the good strategic vision of the management, the proven economic-financial solidity of the Group and the effective and efficient organizational-functional model adopted, which are the solid pillars supporting the process of expansion and growth initiated by Proger. The A2.2 rating is a clear confirmation of all this and places Proger in a league of excellence of Italian entrepreneurship, which for a non-captive and totally private capital company like ours, represents a remarkable result and rewards the excellent work carried out both by the team, which I have the pleasure to lead, and by all the corporate resources who have contributed and continue to contribute daily to the achievement of the company’s objectives.“