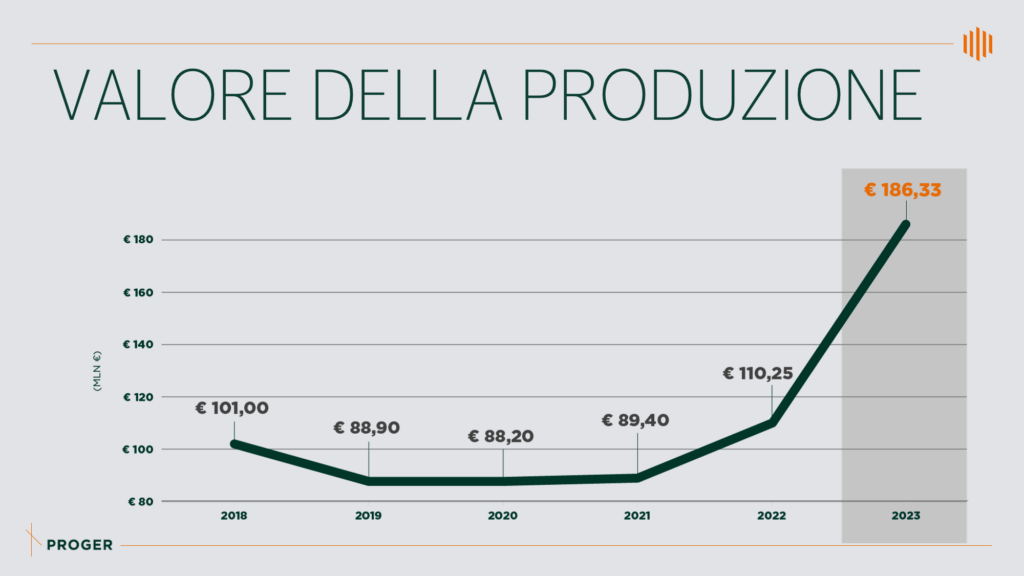

For Proger, a production value of over 180 million in 2023, with a portfolio of around half a billion euros over the next three years.

Presentation of the company's half-year report, forecasts to 31.12.2023 and business plan 2023-2026

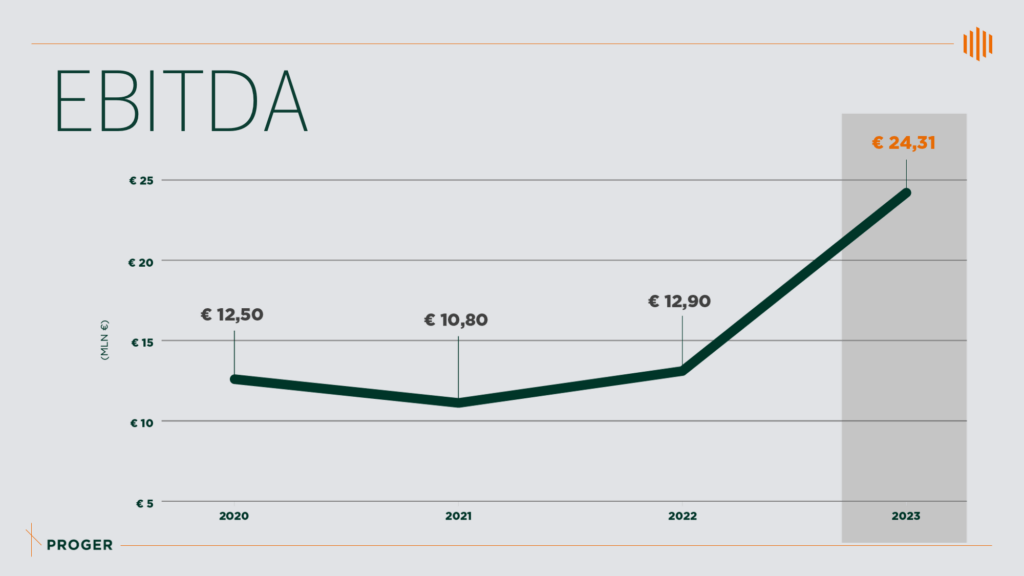

At an event reserved for stakeholders, Proger’s CFO, Roberto Lombardi, presented the company’s results and forecasts for 2023, as well as its business plan for the next three years. For Proger, 2023 will mark the best result in the company’s history, with a projected production value at 31 December of EUR 186 million, +40% compared to 2022, and an EBITDA of EUR 24 million.

The positive results of 2023 can be attributed to the performance of the main business lines of the engineering and management company, which boasts clients such as WeBuild in the infrastructure design sector, Autostrade per l’Italia for safety inspections and maintenance engineering, Eni and Total in the oil and gas sector, and Enel and Terna in the green energy sector.

“In 2023, we have made an important leap forward in terms of production, compared to the average of 100 million developed in recent years,” comments Lombardi. “Our growth model is based on the competence of our resources and the intuitions of our management, which are well supported by the financial system; in fact, to pursue growth of this kind requires strong support both from the banking system and from Proger’s shareholders themselves, who have always reinvested profits in the company because they believe in the persistent development project that Proger has undertaken. With an NFP/PN ratio of 36%, a high level of financial availability and substantial medium-term credit lines provided by the financial system, Proger can explore new markets and generate new business on a solid and secure footing“.

This solidity is confirmed by some of the main indicators highlighted during the presentation: the EBITDA margin (EBITDA/VdP) of 13% shows a good level of remuneration for the activity carried out, particularly in view of the comparative benchmark of around 10%, and the excellent ratio of net financial position (NFP) to EBITDA, at 1.26 (with an average of 3.5 in the sector), summarises the company’s ability to repay bank debt in the short term.

“In addition to the financial data, however, we must not forget that it is essential for us to invest in human capital and training, as this creates value and guarantees the continuity of the growth trend“.

During the presentation, the CFO went on to extend the time horizon of the forecast, illustrating Proger’s business plan up to 2026, which, despite an extremely conservative approach, confirms the current year’s production volumes.

“We have a portfolio of around half a billion euros,” continued the CFO, “but these are values that refer to June 2023 and I can already say that they are on the rise.“

“I cannot deny that our CFO is always very cautious in his forecasts,” interjects CEO Marco Lombardi, “but we are confident that we will not only be able to confirm this year’s VdP, as indicated in the business plan, but that we will be able to go well beyond the €200 million threshold over the next three years. This is because the figures presented do not take into account very concrete scenarios and initiatives in the pipeline that are not yet sufficiently mature to be included in our backlog. One of them, for example, sees us as the technical coordinator of one of the most important infrastructure projects in the world“.

“I remember that in 2014, during a company convention, we announced the goal of becoming number 1 in Italy and reaching 200 M€ of turnover by 2025,” concludes President Umberto Sgambati. “To many it seemed far too ambitious, but today we can say that we are succeeding even ahead of schedule.”